Born partly out of necessity, more organisations worldwide are pursuing remote workers abroad to fill gaps in their workforce. Companies, however, still face several questions before they are able to branch out accordingly. Reason for Undutchables, Netherlands-based expert in recruitment and labour law, to team up with Katja van Leeuwen and Birgit Killens from Interfisc for a webinar to discuss how to hire remote workers outside of the Netherlands.

Interfisc specialises in pay-rolling across borders and has many years of expertise in just how to tackle this situation. They offer tailored advice and help companies hire workers in other countries. Interfisc helps companies who do not know the laws and rules for the country where the employee will be working to figure everything out and make sure that their contracts are up to regulation.

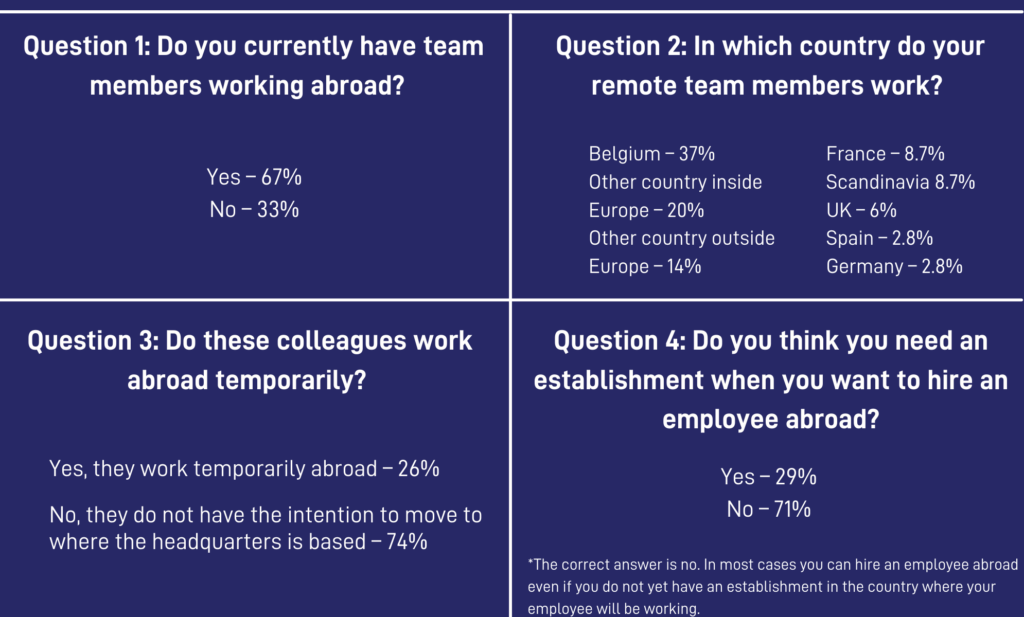

‘67% of Dutch companies have employees working abroad’

According to Undutchables’ poll, 67% of Dutch companies have team members working abroad. Location-wise, Belgium seems to be the common destination, with 37% of organisations having team members work in their neighbouring country. Surprisingly, only 14% of those polled saying they have team members working ‘outside of Europe’.

‘Employers think they can choose for themselves’

Not every hiring scenario is like another, which is all the more true when hiring from abroad. And even more so when that employee will not move to the company’s respective country, but will work remotely from abroad. Ranging from tax and employment laws to differences in the way social security is handled, there are a multitude of factors to take into account when hiring remote workers abroad.

You have to follow the international rules. For social security and tax purposes, the main rule is the country of employment principle.

“Not everybody knows how it really works”, says Interfisc’s Katja van Leeuwen. “I often hear that employers think they can choose for themselves in what country they’ll set up a pay-roll. But that’s not the case. You have to follow the international rules. For social security and tax purposes, the main rule is the country of employment principle. Which state that, for example, an employee of a Dutch company that lives and will be working in the UK, will be subject to social security in the UK, not in the Netherlands.”

“The laws, benefits, and specific regulations will differ, but the risk factors are the same everywhere.”

“One of the key things to note is that the list of risks is the same in every country”, Van Leeuwen says. “The laws, benefits, and specific regulations will differ, but the risk factors are the same everywhere. Employees may fall ill or retire in each country. Contracts can end in each country. That in itself doesn’t change, the risks are the same. But where it varies is the way in which things are dealt with in each country.”

The 7 things that apply for remote workers abroad

For every country, however, the notion applies that you must fulfil certain guidelines before you get started with recruiting abroad. Contracts (and payrolling) differs, employment laws can be different, and each country has different tax and health and safety systems. So what do you need to consider?

1. Country of employment principle

This refers to the guideline meaning that the country where your employee works is also the country where the tax laws, social security, etc. will be applicable. It is wise to adhere to the country of employment rule when setting up your employee contracts, so that you can maintain simplicity and accuracy in your payrolling.

2. Calculating the gross to net wage

Figuring this out ahead of time will help you avoid confusion and make sure that, although the regulations and taxes in the other country may be different, the employee maintains a fair wage and that you can clearly defend any gross wage changes made.

3. Employment Law

Determine what the regulations in the desired country are and how they differ from the normal contract and benefits offered by your company. Although you are allowed, in some cases, to apply what you are familiar with you must also ensure that you follow the mandatory rues of the country of employment.

4. Social Security and required insurances

Keep in mind that every country handles social security and insurances differently, so you will want to research the requirements for you, as an employer, as well as for your employee. The rules of the country of employment are, again, the ones you need to follow.

5. Tax Regulations

Each country will have a different tax rate and system. Keep it simple and remember that the tax regulations that apply are those of the country where the employee is working.

6. Health and Safety

Again, the country of employment principle applies. The administrative rules may be different than you are used to, but it is necessary to follow them, even if it takes some getting used to.

7. Employee Benefits

Here you have the most wiggle room and can choose what benefits you will offer. Keep reading to learn more about our experts’ advice on providing employee benefits across borders.

Read more

- Will the post-Covid workplace really be Back to Better?

- Successfully managing social distance in your global team with a SPLIT framework

- Celebrating 25 years of excellence: How Undutchables became a pioneer for international recruitment

Learn more about the services Undutchables has to offer. Take a look at their website or contact them.